By Bram Westerweel and Rob Basten (Eindhoven University of Technmology) and Jan C. Fransoo (Kuehne Logistics University)

Last fall, ING released a report on the growth of 3D printing as a manufacturing technology. The report includes a scenario in which the rapid growth in of 3D printing equipment would lead to a total share in the global manufacturing equipment of about 50% in 2040. This in turn would lead to a dramatic drop in cross border trade in goods of 38% in 2040.

3D printing will have a significant effect on the manufacturing industry and on global supply chains. However, our analysis shows its effect to be much smaller than ING’s scenario predicts, as our analysis concludes that the decrease in cross border goods trade will likely be less than 7% rather than the 38% announced by ING. Our conclusion if different because we believe the ING report to contain a number of flaws. We outline our reasoning here below, and created some graphs to make that clear.

The key assumptions in the ING report are (on page 8):

- The annual growth rate for investment in 3D printing has been 29% over the past five years, compared to an average of 9.7% for global investment growth in traditional machines. ING assumes that this difference continues to hold in future years.

- In the ING scenario, investments double (to 58%) for 3D printing after five years, while it will fall by a third (to 6.5%) for traditional machines after ten years.

Our analysis of the ING report and the questioning of the above assumptions leads to our following findings:

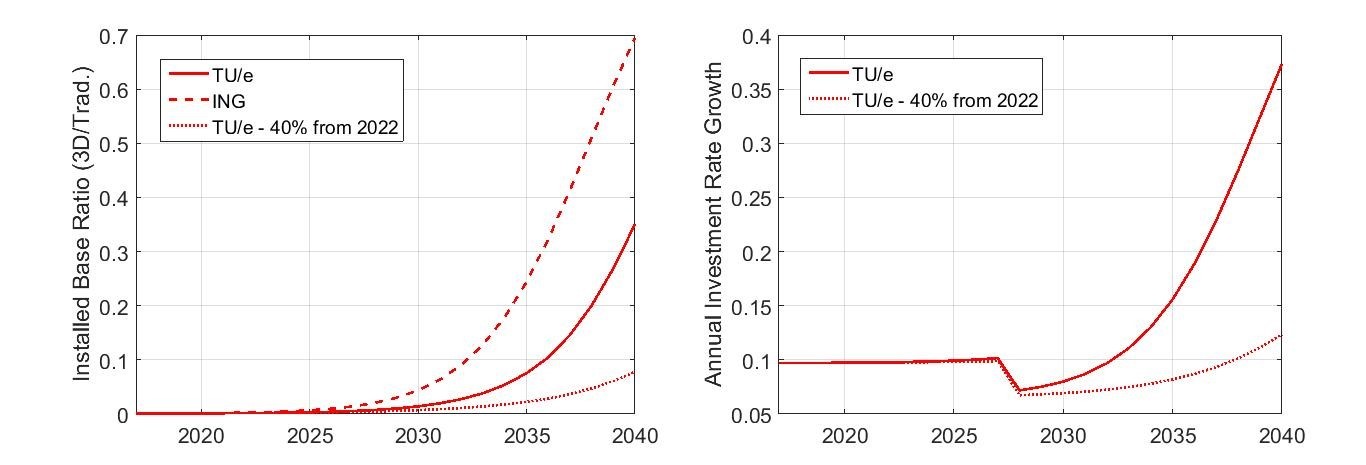

- The ING report confuses annual investments with the installed base.In the ING report, the current rapid growth in annual investment in 3D printing equipment is reflected proportionally in the share of the manufacturing equipment base. However, manufacturing equipment has a long life cycle. In our analysis, we have assumed, for the sake of argument, a life cycle of 20 years. This implies that many of the assets that are acquired in the upcoming decade will still be there in 2040. Given that the far majority of these assets is still in traditional manufacturing technologies (despite the smaller growth rates), in 2040 a much higher share will be still in traditional manufacturing. Inserting this effect into ING’s calculations reduces the projected share of 3D printing equipment in the total manufacturing equipment to 35% in 2040 (instead of 50%), as shown in the TU/e line in the figure above. Note that while this number is clearly lower than ING’s, this is still very impressive.

- The ING report assumes an unsubstantiated annual growth rate of investments in 3D printing equipment of 58% from 2022 onwards. The growth rate in 3D printing equipment is 29% in 2017, according to ING’s source. In the scenario under consideration, ING assumes that this growth rate doubles in 2022 and then continues at this level until 2040 (and beyond). We believe this to be highly unlikely. Growth rates are likely to level off at some point, and unlikely to double on such short notice. The source of this doubling in 2022 and the subsequent persistence of the annual growth rate of 58% for decades is unclear and not mentioned in the report. To illustrate the dramatic effect of this assumption on ING’s calculation, we have used a growth rate of 40% (which we still believe is extremely high) from 2022 onwards. We then find that 3D printing equipment makes up only 8% of the total manufacturing equipment in 2040, as illustrated in the bottom line of our figure.

- The ING report assumes annual growth rates in total investments that are unrealistically high. We are unaware of the source for the 9.7% growth rate in conventional manufacturing equipment that ING assumes. This number may be realistic for a limited period of time, during the current crisis recovery period. However, having year-on-year, until 2040 (and beyond), an annual growth of 9.7% in the investment rate seems unrealistic to us. Still, let’s assume that this is realistic. If we then go back to ING’s scenario, we see that in 2040 the annual growth rate in total manufacturing equipment, i.e., conventional plus 3D printing, is 21%. This effect is due to the extremely high investment growth rates in 3D printing, which by then makes up an increasingly large share of the total manufacturing equipment. With (highly optimistic) growth rates of 40% from 2022 onwards, annual growth in total manufacturing equipment is still 9% by 2040. This type of growth seems unfounded, with a substantial impact on ING’s conclusions.

We are a strong believer in the future of 3D printing technologies. Application in personalized devices, spare parts and – ironically – making flexible tools for traditional manufacturing technologies, will lead to massive changes in many factories. However, the timing and impact on global manufacturing will be very far from the numbers presented by ING. It is unclear to us how ING has translated the impact on global manufacturing exactly to an impact on global trade, but if we simply scale the reduction proportionally, our results at point 2 above would mean that instead of a 38% reduction in trade by 2040, the reduction in trade would be less than 7%.

Besides the much smaller impact on global trade, our analysis also illustrates that models with exponentially increasing growth over long periods of time are unsuitable for conducting such analyses. Even under our adapted assumptions, annual manufacturing equipment growth rates will approach unrealistic values as time progresses as 3D printing would ultimately completely dominate traditional manufacturing. A more credible analysis should, therefore, be based on a more realistic model that allows the ratio of 3D printing and traditional manufacturing to reach some equilibrium, if one wishes to make any claims on the timing and impact of 3D printing on global trade.

Note: We have received a response to a draft of this text from ING’s Raoul Leering. This has clarified a few points, resulting in some changes in the text. His key comment is that the “report does not predict anything! It is only a scenario analysis that shows what happens with world trade IF the current growth rate doubles.” The ING report contains a second scenario in which investments in 3D manufacturing equipment equal traditional manufacturing equipment in 2060. In this response, we focus on the 2040 scenario.Furthermore, ING has not responded to our request to share with us the source of their investment data.